About Third Party Administrators

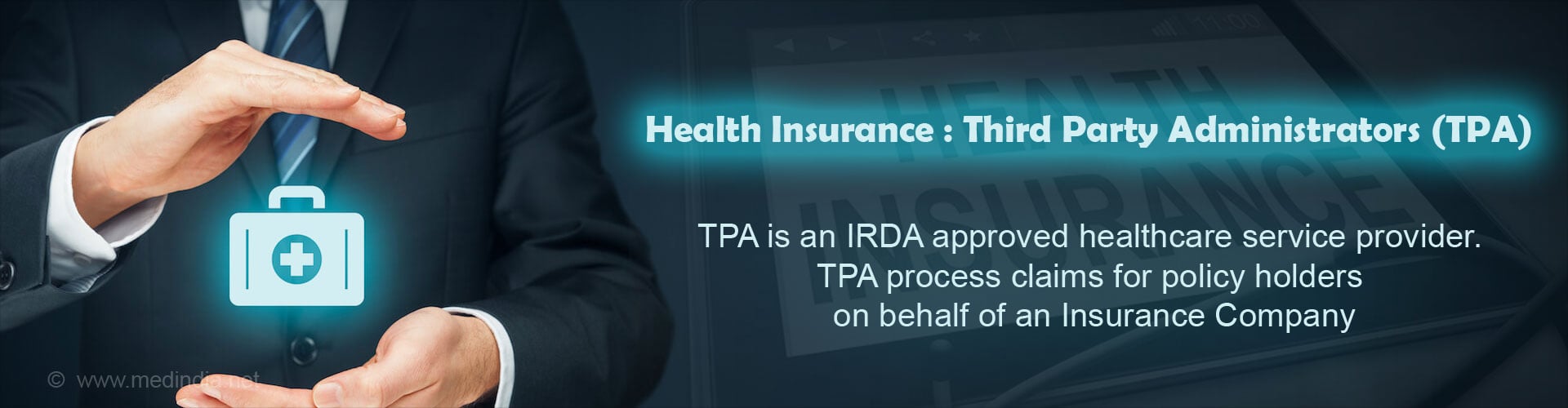

Third Party Administrator (TPA) is an organization, licensed under the IRDA (Third Party Administrators - Health Services) Regulations, 2001 by the Authority, and has a contract with the Insurance company for a payment for providing healthcare services to policy holders.

The Third Party Administrators are intermediaries who connect insurance companies with policyholders and health care providers.

The Insurance Regulatory and Development Authority of India (IRDA) selects the TPAs on the basis of strict professional norms.

The Insurance industry in India has experienced a sea of change since the opening up of the insurance sector for private participation. With a plethora of companies entering the foray in the near future, the health insurance sector is surging forward and is poised for a phenomenal growth.

Health insurance is an important mechanism to finance the health care needs of the people. To manage problems arising out of increasing health care costs, the health insurance industry has assumed a new dimension of professionalism with TPAs.

Further, the uncertainty related to a medical condition increases the need for a health insurance for all the citizens.

Health insurance is any health plan that pools resources up front by converting unpredictable medical expenses into a fixed health insurance premium. It also centralizes funding decisions on health needs of a policyholder. This covers private health plans as well as mediclaim policies.

While call center facilities and personalized financial planning tools are some of the innovative trends experienced in the products front; the best thing to happen on the service front is the introduction of third party administrators as they serve as a vital link between insurance companies, policyholders and health care providers.

TPAs were introduced by the IRDA in the year 2001. The core service of a TPA is to ensure better health insurance services to policyholders. Their basic role is to function as an intermediary between the insurer and the insured and provide cash less service at the time of hospitalization.

A minimum capital requirement of Rs.10 million and a capping of 26% foreign equity are mandatory requirements for a TPA as said by the IRDA. License is usually granted for a minimum period of three years. Ideally, the TPA functions by collaborating with the hospitals for the patients to enjoy hospitalization services on a cashless basis.

Role of the TPA

The introduction of TPAs is of great help and relief to the insurance companies which have been searching for ways and means to get their management expenses get in line with the specifications laid down by the IRDA.

Insurance companies (insurers) can now outsource their administrative activities, including settlement of claims to third party administrators, who offer such services for a cost. The insurers remunerate the TPAs so that the policyholders receive enhanced facilities at no extra cost. Once the policy has been issued, all the records will be passed on to the TPAs and all further association of the insured will be with the TPAs and not with the insurance companies.

With the advent of TPA, the insurance companies aim at ensuring higher efficiency, standardization of charges, greater awareness and penetration of health insurance to a larger section of the people

The TPA undoubtedly aims to give the health insurance industry the required boost in India.

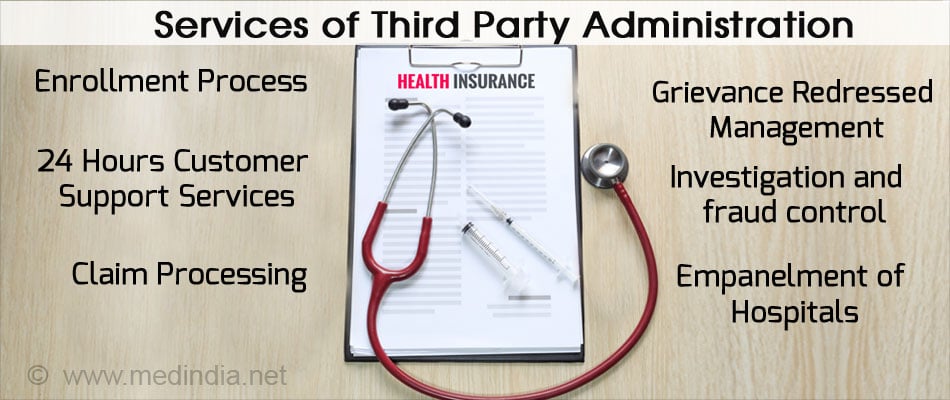

The services provided by TPA are as follows:

- Enrollment process- TPA provides ID cards to all their policyholders in order to validate their identity at the time of hospitalization.

- 24 hours customer support services- providing assistance in case of any new incoming claims, information regarding policyholder's data and provider network hospital, claim status, benefits available with the existing cardholder, any other query related to the insured person’s policy or claim.

- Claim processing- Processing of cashless and reimbursement claims

- Grievance Redressed Management

- Investigation and fraud control

- Empanelment of hospitals to provide cashless facility

The Claim Intimation Process

In case of claim, the insured individual/representative of insured person shall inform the TPA (if claim is processed by TPA)/company (if claim is processed by company) in writing by letter, fax, email or by phone and should provide all necessary information relating to the claim such as consultation reports, diagnosis, plan of treatment, discharge summary, policy no., identity proof among other documents within the given time limit.

- In case of a claim, policyholders will have to inform the TPA on a 24 hr toll-free line provided by them

- After informing the TPA, the policyholder will be directed to a hospital where the TPA has a tied up arrangement. However, policyholders have the option to be admitted at another hospital of their choice in which case, payment will be on reimbursement basis.

- TPA pays for the treatment; they issue an authorization letter to the hospital for the admission of the policyholder in the hospital.

- At the point of discharge, all the bills will be sent to the TPA while they are tracking the case of the insured at the hospital.

- TPA makes the payment to the hospital.

- TPA sends all the documents necessary for consideration of claims, along with the bills to the insurance company.

- The insurance company then reimburses the TPA

Claim Intimation to TPA in Case of Cashless Facility:

- In case of planned hospitalization – TPA should be intimated at least 72 hours before the insured person’s admission to network provider/PPN hospital.

- In case of emergency hospitalization - TPA should be intimated less than 24 hours of the insured person’s admission to network provider/PPN hospital.

Claim Intimation to TPA in Case of Reimbursement:

- In case of planned hospitalization – TPA should be intimated at least 72 hours before the insured person’s admission to network provider/PPN hospital.

- In case of emergency hospitalization - TPA should be intimated less than 72 hours of the insured person’s admission to network provider/PPN hospital.

Checklist for Policy Holders

- Contact your agent or TPA if you have not received your health insurance card from the Third Party Administrator (TPA).

- Before getting hospitalized, check the name of the TPA on the Health Insurance ID cards you have received.

- If in case you have a fresh policy or recently got your policy renewed, check with your TPA on your policy enrollment, failure to do which can result in rejection of your cashless authorization request.

- All cashless claims will be processed directly by the TPA in co-ordination with the hospital. Whereas, for the reimbursement process the insured person has to submit all duly signed and stamped original documents such as final bill, receipts for all the treatment expenses, prescriptions, all investigation reports, document regarding treatment done and discharge summary to the TPA.

- Remember - TPAs do not necessarily work on holidays

List of TPAs in India

List of TPAs in India as on July 2016

| Sl. No. | Name of TPA/License no. | Name of CAO/CEO / Address | Contact Details |

| 1. | United Healthcare Parekh TPA Pvt. Ltd.(License no. 002 renewed from: 21.03.2014) | Mr. Shiva Belavadi Chief Executive Officer, 3A Gundecha Enclave, Kherani Road, Saki Naka, Andheri (East), Mumbai – 400 072 | Customer Service Line: 1800-209-8884 Phone no:- 022-28532400 Fax no: 022- 28527776 Email- shiva.belavadi@uhcpindia.com; contactus@uhcpindia.com Web: http://www.uhcpindia.com |

| 2. | Medi Assist India TPA Pvt. Ltd(License no. 003 renewed from: 21.03.2014) | Mr. Ganesh K Chief Administrative Officer Tower D, 4th Floor, IBC Knowledge Park, 4/1, Bannerghatta Road, Bangalore, 560026 | Phone no: +91 80 49698036 Toll Free Fax No.: 1800 425 9559 Email: ganeshk@mediassistindia.com; cao@mediassistindia.com Web: http://www.mediassistindia.com |

| 3. | MD India Healthcare (TPA) Services (Pvt.) Ltd.(License no. 005 renewed from: 21.03.2014) | Mr. Suresh V. Karandikar Chief Executive Officer S.No. 46/1 E-space A-2 Building, 3rd Floor, Pune-Nagar Road, Vadgaonsheri, Pune – 411 014 | Phone no: 020-25300000 Fax : 020-25300003 Toll free customer care no:- 18002331166 Email id: skarandikar@mdindia.com; customercare@mdindia.com Web: http://www.mdindiaonline.com |

| 4. | Paramount Health Services & Insurance TPA Pvt. Ltd.(License no. 006 renewed from: 21.03.2014) | Mr. R D Misra Chief Administrative Officer, Plot No. A-442, Road No. 28, MIDC Industrial Area, Wagle Estate, Ram Nagar, Near Vitthal Rukhmani Mandir, Thane (W), MS - 400 604 | Phone no: 022-6644 4600/6662 0800Fax: 022-66444754/755 E-mail: nayan.shah@paramounttpa.com; contact.phs@paramounttpa.com Web: http://www.paramounttpa.com |

| 5. | E Meditek (TPA) Services Ltd.(License no. 007 renewed from: 21.03.2014) | Mr. B.S. Kaintura Chief Administrative Officer, 577, Udyog Vihar, Phase – V Gurgaon - 122016 (Haryana) | Phone no: 0124-4466600 Fax : 0124-4466677 Toll free: 1800113242 E-mail:bskaintura@emeditek.com; customercare@emeditek.comWeb: Web: http://www.emeditek.co.in |

| 6. | Heritage Health TPA Pvt. Ltd.(License no. 008 renewed from: 21.03.2014) | Mr. Surendra Kumar Tiwari, CAO, NICCO HOUSE ( 5th Floor) 2, Hare Street Kolkata-700001 | Phone no: 033-22482784, 22486430, Fax: 033-22100837/ 22310287 Toll free: 1088-345-3477 E-mail: stiwari@bajoria.in Web: http://www.heritagehealthtpa.com |

| 7. | Focus Health services TPA Pvt. Ltd.(License no. 010 renewed from: 21.03.2014) | Mr. Sujit Bhattacharya Chief Administrative Officer, Focus Healthcare Private Limited, AB-16, Safdarjung Enclave, Community Centre, New Delhi-29 | Phone no: 011-41332555; Fax: 011-41332599 Toll free no: 1800 112 999 or +91-120-6900002 E-mail: cao@focustpa.com; info@focustpa.com Web: http://www.focustpa.com |

| 8. | Medicare TPA Services (I) Pvt. Ltd.(License no. 012 renewed from: 21.03.2014) | Shri. Dipankar Roy Chief Administrative Officer Flat No 10, Paul Mansions , 6B, Bishop Lefroy Road, Kolkata - 700 020 | Phone no: 033-2281 2826, 9831184120 2280 9510/ 2280 9791 Fax-033-2280 6111 Toll Free no: 18003453339 Email: medicareho@medicaretpa.co.in Web: http://www.medicaretpa.com |

| 9. | Family Health Plan (TPA) Ltd.(License no. 013 renewed from: 21.03.2014) | Ms. G. Bharathamma Chief Administrative Officer M/s Family Health Plan Ltd. Ground Floor, F1, Srinilaya, Cyber Spazio, Road No. 02, Banjara Hills, Hyderabad – 500 034 | Phone no: 040-23556464 Fax: 040-23541400 Toll free no.- 1-800-425-4033 Email id- bharathig@fhpl.net; Info@fhpl.net; grievances@fhpl.net Web: http://www.fhpl.net |

| 10. | Raksha TPA Pvt. Ltd.(License no. 015 renewed from: 01.04.2014) | Mr. Pawan Bhalla Chief Executive Officer C/o Escorts Corporate Centre15/5, Mathura Road, Faridabad, Haryana – 121 003 | Phone no: 0129-2564057, 2564083, 2250000, 4289999,18001801444 Fax: 0129-4018012/ 2250002 Email - raksha@rakshatpa.com; pawan@rakshatpa.com Web: http://www.rakshatpa.com |

| 11. | Vidal Health TPA Private Limited(License no. 016 renewed from: 16.05.2014) | Ms. Sudha Suhas Kulkarni Chief Administrative Officer, Tower 2, 1st flr, SJR I Park, Plot No. 13,14,15, EPIP Zone, Whitefield, Bangalore - 560 066 | Phone no: 080-40125678 Email- sudha@vidalhealth.com; care@vidalhealthtpa.com Fax: 080-28418216/17 Toll free: 1800 345 4051 Web: http://www.vidalhealthtpa.com |

| 12. | Anyuta TPA in Healthcare Pvt. Ltd.(License no. 017 renewed from: 16.05.2014) | Ms. Ratna Seetarama Chief Administrative Officer, No.: 31/18, Main Road, Loyola Layout, Ward No. 111, Shanthala Town, Bangalore - 560 047 | Landline / Fax : 080-41128311 / 25364766 Toll free no: 18004251111 Web: http://www.anyutatpa.com |

| 13. | East West Assist TPA Pvt. Ltd.(License no. 018 renewed from: 16.05.2014) | Mr. Neeraj Batra Chief Executive Officer 97, Manek Shaw Road, Sainik Farms, Near Anupam Gardens, New Delhi – 110068 | Phone no: 011-47222666, 29554348, 29554349, 29551129 Fax :011- 29554130/ 29553033 Toll free no. 1800-1111-46 Email: assistance@eastwestassist.com; nbatra@eastwestassist.com Web: http://www.eastwestassist.com |

| 14. | Med Save Health Care TPA Ltd. (License no. 019 renewed from: 15.05.2014) | Mr. Vivek Tiwari Chief Executive Officer F-701A, Lado Sarai, Behind Golf Course, Mehrauli, New Delhi – 110 030 | Phone no: 011-29521061-66, 39001234 Fax – 29521067/71Tollfree -1800111142 Email: vt@medsave.in; info@medsave.in Web: http://www.medsave.in |

| 15. | Genins India Insurance TPA Ltd. (License no.020 renewed from: 11.06.2014) | Mr. Subhash Chander Khanna, CAO Chief Administrative Officer D-34, Ground Floor, Sector-2 NOIDA-201301 | Phone no: 0120- 4144 123 (10 lines), 120-4144100 Fax -0120-4144 170/ 171 Fax : 0120-2430064 Toll free no.- 1600-345-3323 Email: sckhanna@geninsindia.com; gil@geninsindia.com Web: http://www.geninsindia.com |

| 16. | Alankit Insurance TPA Limited (License no. 021 renewed from: 18.11.2014) | Mr Bodh Raj Punj Director & Chief Executive Officer Flat Nos.201, Second Floor, Vikas Surya Mall, Sector-3, Rohini, New Delhi - 110 085 | Phone no: 011-49355621 to 49655627 Fax : 011-49355620 & 49355630 Toll Free No. 1800-11-3300 Call Center - +91-11-42541621-24 E-mail:alok@alankit.com; health@alankit.com Web: http://www.alankithealthcare.com |

| 17. | Health India TPA Services Private Limited.(License no. 022 renewed from: 18.11.2014) | Mr. Kamaljeet Gupta CAO and Joint MD Anand Commercial Co. Compound, 103-B L B S Marg, Gandhi Nagar, Vikhroli ) Mumbai-83 | Phone no: 022-42471900 (80 lines) Fax-022-42471910/911/946, 25783382 Toll free no. – 1800-2201-02 Customer care – 022-66131199 E-mail: kamaljeetg@healthindiatpa.com; crm@healthindiatpa.com Web: http://www.healthindiatpa.com |

| 18. | Good Health TPA Services Ltd. (License no. 023 renewed from: 27.01.2015) | Ms. Saigeeta Dikshit, Chief Administrative Officer, 8-2-1/8/1, S.V.R. Towers, 4th Floor, Srinagar Colony Road, Panjagutta, hyd-82 | Phone no: 040 – 66825001/003, 23735006 Fax : 040-66828081/88 /89 Toll free no. – 1860-425-3232 E-mail: saigeeta@ghpltpa.com Web: http://www.ghpltpa.com |

| 19. | Vipul Med Corp TPA. Pvt. Ltd. (License no. 024 renewed from: 01.03.2016) | Mr. Rajan Subramaniam Chief Executive Officer, 515, Udyog Vihar, Phase V, Gurgaon – 122 016 | Phone no: 0124-2438270-75 Fax: 0124-2438276,4699611-12 4308211 Toll free no: 1800-108-7477 E-mail: rs@vipulmedcorp.com; info@vipulmedcorp.com Web: http://www.vipulmedcorp.com |

| 20. | Safeway Insurance TPA Pvt. Ltd (License no. 026 renewed from: 20.07.2014) | Mr. Mahesh Sharma , CEO 815, Vishwasadan, District Centre, Janakpuri, New Delhi-1100058 | Phone no: 011-4142 5671, 25464823 Fax.: 011-41425672/912266466797 Toll free no.- 18001025671 E-mail: support@safewaymediclaim.com; drdivneet@safewaymediclaim.com Web: http://www.safewaymediclaim.com |

| 21. | Anmol Medicare TPA Ltd.(License no. 027 renewed from: 27.10.2014) | Mr P. S. Kshatriya Chief Executive Officer No. 3, 2nd Floor, NBCC House, Near Shajanand College, Opp. Stock Exchange, Ambavadi, Ahmedabad – 380015, Gujarat | Phone no: 079-40009926, 40009936, 40009999 Fax.: 079-40009990 Toll Free no - 1800 233 1999 Fax - +91 - 79 – 61609990 E-Mail - inquiry@anmolmedicare.com; prithvi@anmolmedicare.com |

| 22. | Dedicated Healthcare Services TPA (India) Private Limited.(License no. 028 renewed from 26.04.2015) | Ms. Anahita Daver, Chief Administrative Officer, Cambata Building, (Eros Theatre Building) East Wing, 2nd Floor, 42 Maharishi Karve Road, Mumbai-400 020 | Phone no: 022-22875052, 022-66275900 Fax number: 022- 2287 4235, 022-22874235 Email – iba@dhs-india.com; contactus@dhs-india.com; anahita@dhs-india.com Web: http://www.dhs-india.com |

| 23. | Grand Health Care TPA Services Private Limited.(License no. 029 renewed from 16.05.2015) | Mr Bibhutosh Chattopadhyay Chief Administrative Officer 45A Hindustan Park, P.S.: Gariahat Kolkata -700 029 West Bengal | Phone no: 033- 40274747 Mobile number: 9830063492 / 9051288050 Toll Free number 1800 102 4747 Fax Number 033-400433344 E-mail- adm.grandtpa@gmail.com / help.grandtpa@gmail; cao.grandtpa@gmail.com Web: http://www.grandtpa.co.in |

| 24. | Ericson Insurance TPA Pvt. Ltd.(License no. 035 renewed from 18.12.2015) | Dr. Krishna P. Jaiswal, MD Ericson TPA Healthcare Pvt. Ltd. 4th Floor, New Vijay Cinema Building S.T.Road, Chembur Mumbai - 400 071 (MH) | Phone no: 022 – 25280280 E-mail: krishna@ericsontpa.com Toll Free line: 1800 22 2034Fax: 022-25270200 Web: http://www.ericsontpa.com |

| 25. | Health Insurance TPA of India Ltd. (License no. 036 issued from 06-06-2014) | Shri.M.N. Sarma, M.D. & CEO, Corporate Office; 3rd Floor, IFCI Tower, 61, Nehru Place, New Delhi – 110 019 | Phone no: 011-49043300 Fax: 011-49043399 Toll free numbers - E-mail: sarma.mn@healthinsurancetpa.co.in; customerservice@hitpa.co.in Web: http://www.hitpa.co.in |

Dos and Don'ts For Policyholders

The following points should be noted when availing cashless services from Third Party Administrators:

Do’s:

- Pre-authorization form should be obtained from the Insurance helpdesk 3-4 days prior from the date of admission in case of planned hospitalization.

- The treating doctor should fill the Pre-authorization form.

- The pre-authorization approval at the insurance helpdesk should be checked out within 24hrs.

- Cashless treatment at the hospital can be availed after receipt of written authorization from TPA for the covered treatment.

- The TPA has the right to deny pre-authorization in case the insured person has not provided the relevant medical details.

- At the time of discharge leave all the entire original documents and signed claim form with the hospital.

- In case of clarifications, the TPA office must be contacted.

- Payment to the hospital for the expenditure over and above the TPA-approved limit, or for treatments not covered under the package, must be made by the policyholder at his cost.

Dont’s:

- Admission at the hospital merely for investigation, evaluation or health check-ups will not be approved by TPAs.

- Do not insist for cashless service at the hospital without obtaining the pre-authorization approval from TPA.

- Don't carry back any original documents at the time of discharge from the hospital, if the TPA approves your cashless claim.

Before undergoing any treatment, check all the facts with TPA's to avoid disappointments.

TPA-related Challenges

The challenges perceived by hospitals and policyholders in availing services of TPA are-

- Policy holders mostly rely on their insurance agents

- Less awareness among policyholders about the existence of TPA.

- Policyholders have very little knowledge about the empanelled hospitals for cashless hospitalization services.

- In settling of their claims by the TPAs, the health- care providers experience delays as the TPAs insist on standardization of medical services/ procedures across providers.

- Hospital administrators perceive significant burden in terms of effort and expenditure after introduction of TPA.

- Hospital administrators foresee business potential in their association with TPA in the long run though as of now there is no substantial increase in patient turnover after empaneling with TPAs.

Future Role of TPAs

In the fast developing health insurance sector the TPAs have crucial roles to play in the future. Some of them are–

- Medical examination services for life insurance policies and overseas mediclaim policies

- Record verification under adjustment policies

- Documentation and policy issuing

- Co-insurance recovery services for both premiums and claims

- Follow up of recoveries from reinsurance companies

- Servicing of motor policies

- Arbitration services

- Inspection and assessment of risk prior to issuing the policy

Developing viable mechanisms would help TPAs to strengthen their human capital and ensure smooth delivery of their services in an emerging health insurance market.