Current excise and VAT rates are insufficient to increase the prices of non-cigarette tobacco products, making them easily affordable and cheaper.

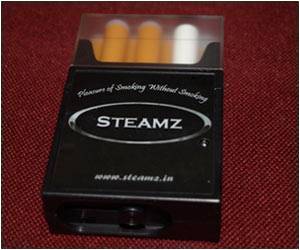

Current excise and Value Added Tax (VAT) rates are insufficient to increase the prices of non-cigarette tobacco products, making them easily affordable and cheaper than essential food items, said a study by the Institute for Studies in Industrial Development (ISID) and Public Health Foundation of India (PHFI).

On the other hand, high incidence of taxes has made legal cigarettes extremely unaffordable in India, the Tobacco Institute of India said. Citing an analysis done by the World Health Organisation in 2015, the Institute said that cigarette taxes (excise duty and state VAT) in India are amongst the highest in the world.

"In fact, cigarette taxes in India are 14 times higher than USA, nine times higher than Japan, seven times higher than China, five times higher than Australia and three times higher than Malaysia and Pakistan," said the statement.

Source-IANS