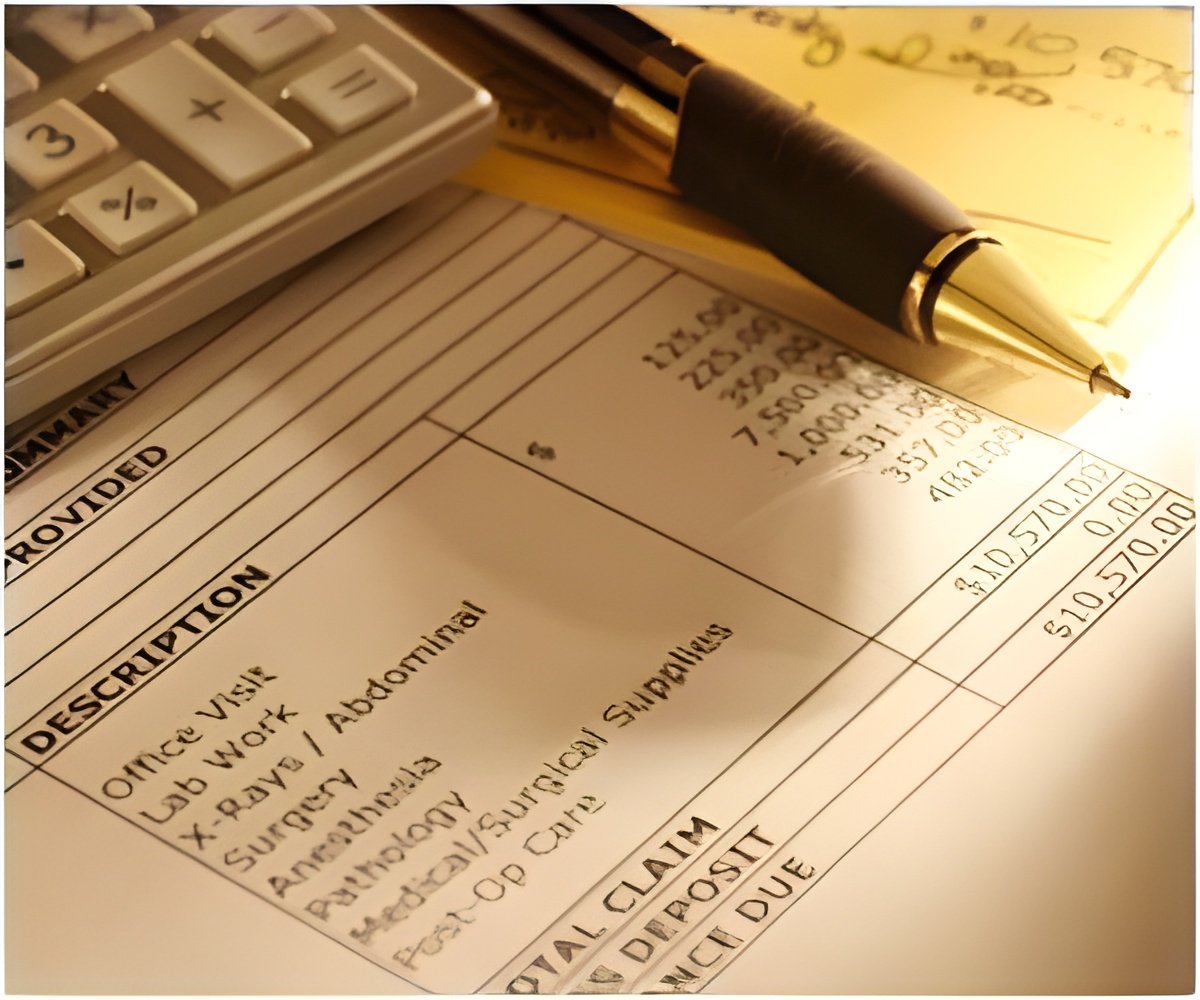

When you are sure of exactly what the insurance company will pay against your policy it is easy to claim a cashless hospitalization or reimburse the money with bills.

Health insurance can be claimed when a person is admitted to the hospital for 24 hours, though now there are some exceptions for “Day care treatments”, which include eye surgery chemotherapy, tonsillectomy, ligament repairs and prostate surgery, are some of the procedures included. Health insurance covers room charges, surgical procedures etc. It also covers pre and post hospitalization expenses.

All the heads that are covered under a specific policy are mentioned in the policy document that you receive when you purchase your insurance. Naturally, you can only lodge a claim for conditions, which are covered, under your health insurance policy. So read your policy document carefully in advance so that you are sure of what is covered and the exclusions.

The process of claiming health insurance depends on whether you opt for the Cashless facility or Reimbursement of expenses, at the time of admission into the hospital. Cashless facility – There are a number of reputed hospitals that have tied up with insurance companies to offer patients a cashless experience, wherein the hospital bills are directly paid by the insurance company, to the extent specified in the policy. These hospitals are called ‘Network Hospitals’. In order to settle a cashless claim, you must avail treatment at a network hospital.

At the time of admission or just before admission you need to inform the hospital to fill in the hospital administration to fill in cashless request form and submit it to the insurance and from there to the TPA. The insurance will then issue a letter to the hospital to authorize financial limits on facilities and procedures according to the policy.

When you are discharged, the bills are settled directly by the TPA/insurer to the extent of your policy coverage and the authorization of your insurance company.

Advertisement

One of the biggest fears of health insurance policy holders is that after paying the premium and expecting to benefit from the policy, they will be let down by a rejection after lodging a claim.

Advertisement

Claim a stress free recovery once you have purchased a health insurance policy that adequately covers your needs, you can rest assured that in the case of an illness that is covered, your finances will be taken care of.

Reference: Anuj Gulati