The US market of Crohn’s disease therapy is expected to grow at a CAGR of 5.1%, reaching $12.2 billion in sales in 2032.

Crohn's Disease in Major Markets

Go to source) GlobalData's report, "Crohn's Disease – Global Drug Forecast and Market Analysis to 2032," assesses the potential impact of late-stage pipeline agents on the CD market and analyzes key industry forces and events shaping the market's future.

Crohn's Disease: Understanding the Inflammatory Bowel Condition

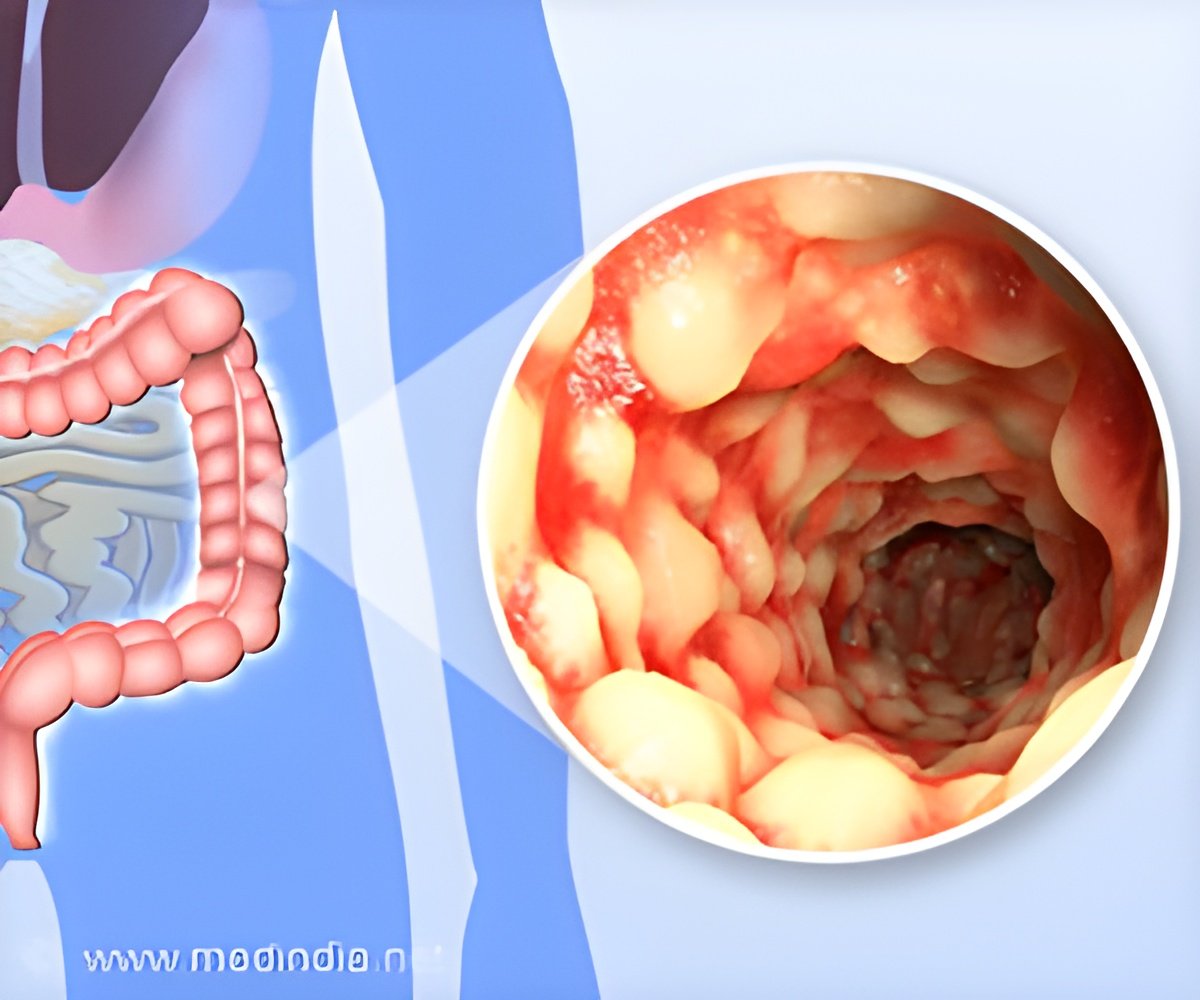

Crohn’s disease also known as regional enteritis or granulomatous enteritis is an inflammation of the small intestine. Along with ulcerative colitis it is grouped under the category of inflammatory bowel disease. The two diseases have some differences but have much in common between them. Both are characterized by bouts of abdominal pain, diarrhea and bleeding from the rectum. The disease usually subsides on its own or with treatment only to recur after some weeks or months (remissions and relapses). The disease also reveals itself outside the intestines in the form of back pain, uveiitis (red eye), and skin nodules.‘While the Crohn’s disease therapy market will face competition from the entry of biosimilars, substantial growth is anticipated over the next 8-10 years, primarily due to the introduction of new treatment options. #crohnsdisease #digestivehealth’

According to GlobalData, a leading data and analytics company, CD drug sales across the eight-major markets (8MM*) are projected to grow at a compound annual growth rate (CAGR) of 4.7%, increasing from $9.5 billion in 2022 to $15.0 billion in 2032. Adeleke Badejo, Senior Analyst of Immunology at GlobalData, highlights the significance of the maturation of the selective anti-interleukin (IL)-23 drug class in the landscape. The anticipated launches of Janssen's Tremfya (guselkumab) and Lilly's mirikizumab in the US and Europe in late 2025 and 2026, respectively, are expected to shape the market. These pipeline agents, along with AbbVie's Skyrizi, may emerge as second-generation therapies over Janssen's non-selective anti-IL-12/23 Stelara.

Badejo also notes the influence of small molecules on the market, driven by patient preference for oral administration over intravenous or subcutaneous biologics. These drugs include AbbVie's approved Janus kinase (JAK) inhibitor Rinvoq and pipeline sphingosine-1 phosphate receptor modulators (S1PRs) such as Bristol Myers Squibb's Zeposia and Pfizer's etrasimod.

With 11 late-stage pipeline assets expected to enter the CD market during the forecast period, combined sales in the 8MM are projected to reach approximately $3.6 billion by 2032. Anti-IL-23 and anti-TL1A therapies, including Merck's MK-7240, Teva's TEV-48574, and Telavant's RVT-3101, are expected to be market leaders with a significant impact.

Similarly, the 5EU (France, Germany, Italy, Spain, and the UK) will also experience growth, with the UK leading with a CAGR of 4.4%. Germany will remain the largest market within the 5EU, contributing $858.7 million to the predicted $2.2 billion CD sales in 2032, although it will experience the smallest market gain with a CAGR of 1.9%.

Advertisement

- Crohn's Disease in Major Markets - (https://www.globaldata.com/store/report/crohns-disease-major-market-analysis)