Budget 2024-25 introduces reforms to reduce costs of cancer treatment, diagnostic equipment, and promote telemedicine, seafood nutrition, and environmental health.

- Customs duties on key cancer drugs fully exempted

- Reduced costs for diagnostic imaging equipment

- Promoted affordability of telemedicine and nutritious seafood

Summary of the Union Budget 2024-2025

Go to source). From reducing customs duties on crucial medical equipment to incentivizing domestic production, these changes are poised to enhance healthcare accessibility and foster industry growth.

The new budget reforms could cut cancer drug prices by up to 20%! #budget2024 #medindia #health’

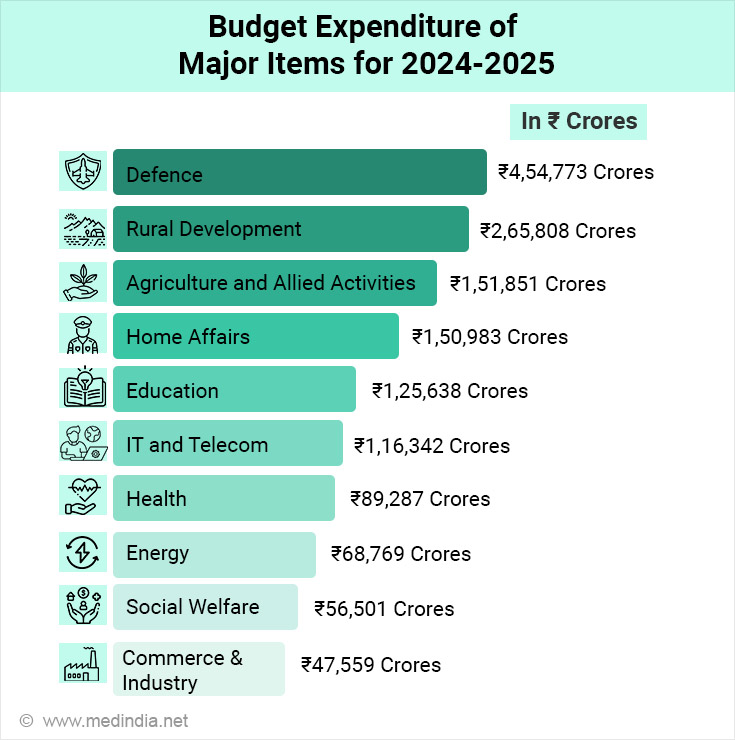

Budget Allocations for Health Sector

- The Health and Family Welfare sector has been allocated a total budget of ₹87,656.90 crores (3✔ ✔Trusted Source

Department of Health and Family Welfare

Go to source). -

The Health Research sector has been allocated a total budget of ₹3,301.73 crores (2✔ ✔Trusted Source

Key Features of Budget 2024-2025

Go to source). -

The total budget allocated for the health sector is ₹90,958.63 crores (4✔ ✔Trusted Source

Department of Health Research

Go to source).

A Boost for Cancer Treatment

One of the most impactful changes in the budget is the full exemption from customs duties for three essential cancer medications: Trastuzumab, Deruxtecan, Osimertinib, and Durvalumab. These drugs, pivotal in treating various types of cancer, are now set to become more affordable for patients.By reducing the cost of these life-saving treatments, the government aims to alleviate the financial strain on cancer patients and improve their access to cutting-edge therapies. This move represents a significant step toward making high-quality cancer care more accessible to those in need.

Reducing Diagnostic Costs

The budget has also addressed the cost of medical diagnostics by reducing Basic Customs Duty (BCD) on X-ray machine tubes and flat panel detectors. This reduction is expected to lower the price of diagnostic imaging equipment, which will, in turn, benefit healthcare providers and patients alike. Enhanced affordability of diagnostic tools could lead to improved diagnostic accuracy and accessibility, ultimately contributing to better patient outcomes.Healthcare professionals have long advocated for the government to broaden the scope of drugs eligible for GST and import duty exemptions, particularly to include all oncology medications. This expansion is seen as a crucial step in enhancing patient affordability. Dr. Shyam Aggarwal.

Enhancing Healthcare Accessibility

Chairman of Medical Oncology at Sir Ganga Ram Hospital, emphasized, “Cancer drugs are costly but crucial for saving lives, as patients often need prolonged treatment. Measures that reduce these costs are highly beneficial, especially since cancers are frequently diagnosed at advanced stages in India.”According to the National Cancer Registry Programme (NCRP), cancer poses a significant health challenge in India, with about 1 in 9 individuals expected to face this disease during their lifetime. Health experts believe that extending these exemptions will make cancer treatments more accessible to patients.

Dr. Mandeep Singh Malhotra, Director of Surgical Oncology at CK Birla Hospital, noted that the impact of these exemptions on treatment costs will vary based on current customs duties and other factors such as import taxes and logistics. “Exempting basic customs duties could lower drug prices by 10-20%, thus improving affordability for patients. However, a precise understanding of the cost reduction requires a detailed analysis of the pricing and duty structure,” he explained.

The government’s National Medical Devices Policy-2023 aims to decrease import reliance by 70% and establish India as a global manufacturing hub for medical devices. "This announcement supports ongoing investments in becoming a leading manufacturer of x-ray equipment worldwide. We recently highlighted concerns about the increased customs duty and the removal of benefits for importing x-ray tubes and flat panel detectors under the Phased Manufacturing Programme (PMP). Given the lack of domestic manufacturers for these crucial components, the government’s relief is highly appreciated," said Rajiv Nath, Forum Coordinator of the Association of Indian Medical Device Industry (AiMeD).

Impact of Budget Changes on Technology, Healthcare, and Environmental Sustainability

The reduction of Basic Customs Duty on mobile phones, Printed Circuit Board Assembly (PCBA), and mobile chargers to 15% is expected to make these devices more affordable. While this primarily affects the technology sector, it also has indirect benefits for healthcare. Affordable communication tools can enhance telemedicine services, which are increasingly important for delivering healthcare to remote and underserved areas. Improved access to mobile technology supports the broader goal of integrating digital health solutions into everyday care.The budget has also reduced Basic Customs Duty on broodstock, polychaete worms, shrimps, and fish feed to 5%. This reduction aims to boost India’s seafood exports and support the fishing industry. For the health sector, this means improved availability of high-quality seafood, which is a valuable source of nutrients and can contribute to better public health outcomes.

The budget’s adjustment of customs duties on various items, such as increasing Basic Customs Duty on PVC flex banners due to environmental concerns, reflects a commitment to balancing economic growth with environmental protection. While this might increase costs for certain products, it underscores the importance of environmental sustainability in overall public health.

Overall, the budget reforms bring a mix of direct and indirect benefits to the health sector. By making cancer treatments more affordable, enhancing diagnostic capabilities, and supporting technological advancements, these changes aim to improve public health outcomes. Additionally, the focus on sustainability and domestic manufacturing helps create a healthier environment and a more robust economy, which ultimately benefits the healthcare system and the public at large.

Reference:

- Summary of the Union Budget 2024-2025 - (https://pib.gov.in/PressReleasePage.aspx?PRID=2035618)

- Key Features of Budget 2024-2025 - (https://www.indiabudget.gov.in/doc/bh1.pdf)

- Department of Health and Family Welfare - (https://www.indiabudget.gov.in/doc/eb/sbe46.pdf)

- Department of Health Research - (https://www.indiabudget.gov.in/doc/eb/sbe47.pdf)

Source-Medindia