A shift in food and beverage consumption patterns is being driven by the rise of GLP-1 medications like Mounjaro and Ozempic, prompting food companies to adjust their marketing strategies.

Characteristics and food consumption for current, previous, and potential consumers of GLP-1 s

Go to source).

‘Did You Know?

Among adults ages 20 and older, 77.1% of men and 69.4% of women have overweight or obesity. #medindia #obesity #men’

Among adults ages 20 and older, 77.1% of men and 69.4% of women have overweight or obesity. #medindia #obesity #men’

Advertisement

Changing Food Consumption Patterns

The results of a recent national study conducted by the Arkansas Agricultural Experiment Station found that these weight loss drugs — known as Glucagon-like peptide-1 agonists or GLP-1s — lead to new food and drink consumption patterns, which underscore observed changes in food and beverage marketing.“We’ve already seen a shift in how food companies market their products,” said Brandon McFadden, professor and Tyson Endowed Chair in Food Policy Economics with the experiment station and the Dale Bumpers College of Agricultural, Food and Life Sciences. “For packaged food companies, stock prices were going down while the stock prices for pharmaceutical companies that make these medications were going up.”

Advertisement

Shift in Food Marketing

An example of the shift, McFadden said: not long after presenting data on his research to an international audience, a major packaged food manufacturer came out with a “meal in one” bar marketed to GLP-1 users. Smoothie King had already seen the writing on the wall, too, and created a menu section dedicated to “GLP-1 Support.”While previous consumer behavior studies have shown GLP-1s caused lower preference for high-fat foods and promoted weight loss, there has been limited information on how it influenced food preferences and consumption behavior across different food categories, McFadden said of a study he and collaborators recently published.

Understanding GLP-1 Medications

For the study, they surveyed current, previous, and potential consumers of GLP-1s to better understand how taking these medications affects food choices. The study also included people who did not plan to take a GLP-1.The current market for GLP-1s approved by the FDA for weight management includes Saxenda, Wegovy, Ozempic, Zepbound, and Monjaro.

Surge in GLP-1 Use

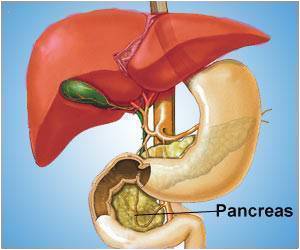

Approved by the U.S. Food and Drug Administration for use in helping lose weight, GLP-1s saw a 300 percent increase in use between 2020 and 2022. GLP-1s were developed for blood sugar regulation in diabetes patients and curb appetite by mimicking the natural GLP-1 hormone found in the lower intestine, simulating insulin release from the pancreas in response to eating or drinking. The result is significant weight loss. Randomized-controlled trials have shown that GLP-1s reduce body weight by 15 percent or more.Tens of thousands of new users were estimated to have started using GLP-1s every week in 2024, and it is estimated that at least half of the people in the U.S. would qualify for a prescription, according to the study from the experiment station, the research arm of the University of Arkansas System Division of Agriculture.

Rising Obesity Rates and GLP-1 Eligibility

Around 42 percent of the U.S. population is estimated to be obese, and another 31 percent are overweight, the study noted. According to the Centers for Disease Control and Prevention, a body mass index of 30 or higher indicates obesity, and a body mass index of 25 to 29.9 is considered overweight.GLP-1s are approved for weight loss in adults who have a body mass index of 30 or higher, and those who are overweight with a body mass index of 27 or higher with at least one weight-related health condition such as high blood pressure, high cholesterol, and type 2 diabetes.

The study found that current and previous users of GLP-1s reported reduced consumption of most foods and beverages. The proportion of respondents reporting less consumption of processed foods was about 70 percent more than of those who reported consuming more. Similarly, there were about 50 percent more respondents who reported consuming less soda, refined grains, and beef than those who reported consuming more of those foods. There were also reductions in the consumption of starchy vegetables, pork, alcohol, fruit juice, and dairy milk.

Continued Desire for Certain Foods

Chicken, coffee, fish and seafood, nuts, eggs, plant-based meat, whole grains, and plant-based milk also saw a relatively smaller dip in consumption, ranging from 10 to 25 percent of respondents reporting decreases in consumption compared to increases.Despite the declines, GLP-1 users reported a continued desire to consume processed foods, sodas, refined grains, and beef.

Increase in Healthy Choices

Only fruits, leafy greens, and water showed an overall increase in consumption.“These results highlight how a GLP-1 might increase consumption of options like fruit and water, even though those taking a GLP-1 desire them less than others,” the study noted.

Andrew Dilley, a Bumpers College graduate student in the agricultural economics and agribusiness department, was the lead author of the study with McFadden as his adviser. Co-authors included Saroj Adhikari and Pratikshya Silwal, agricultural economics and agribusiness department post-doctoral researchers, and Jayson Lusk, professor, vice president, and dean of Oklahoma State University’s Division of Agricultural Sciences and Natural Resources.

“Our study shows that adoption of GLP-1 agonists changes both the amount and types of food people eat,” Lusk said. “These results have important implications for the food industry. If adoption of GLP-1s continues to increase, food companies will be challenged as demand for processed foods falls but will have opportunities as demand for fruits and vegetables increases.”

Reference:

- Characteristics and food consumption for current, previous, and potential consumers of GLP-1 s - (https://www.sciencedirect.com/science/article/pii/S0950329325000825?via%3Dihub)

Source-Eurekalert